A simple interest rate off 4% a-year means an annual interest percentage away from $a dozen,000. After 3 decades, the fresh debtor might have generated $twelve,000 x thirty years = $360,000 for the appeal costs, which explains exactly how financial institutions return as a consequence of finance, mortgage loans, and other particular credit.

Compound Interest rate

Specific loan providers prefer the substance appeal strategy, for example the fresh debtor will pay a lot more from inside the interestpound attract, often referred to as attract into attention, is actually used each other with the prominent in order to the accumulated attention made throughout the earlier periods. The lending company takes on you to definitely after the first year the newest debtor owes the primary also appeal for that year. The financial institution plus assumes on that after the following 12 months, this new borrower owes the primary and attract to the basic 12 months in addition to desire into the appeal on the first 12 months.

The attention due when compounding is higher than the attention due by using the simple attention means. The eye try recharged month-to-month to your dominating in addition to accumulated notice about previous weeks. To have less time structures, the fresh formula interesting could well be similar for both steps. Because the credit go out develops, yet not, the fresh difference between the two sort of attention data expands.

By using the example significantly more than, at the end of three decades, the due into the desire is virtually $673,019 towards the a beneficial $300,000 financing which have a great 4% interest rate.

Let us take a look at a different sort of analogy. Finally, just like the resolved about formula lower than, he pays $1, when you look at the attract towards the loan:

Substance Desire and Offers Membership

Once you spend less having fun with a bank account, substance appeal was good. The attention gained in these levels are compounded and is compensation to your https://paydayloancolorado.net/colona/ membership proprietor to own enabling the lending company to make use of the newest placed loans.

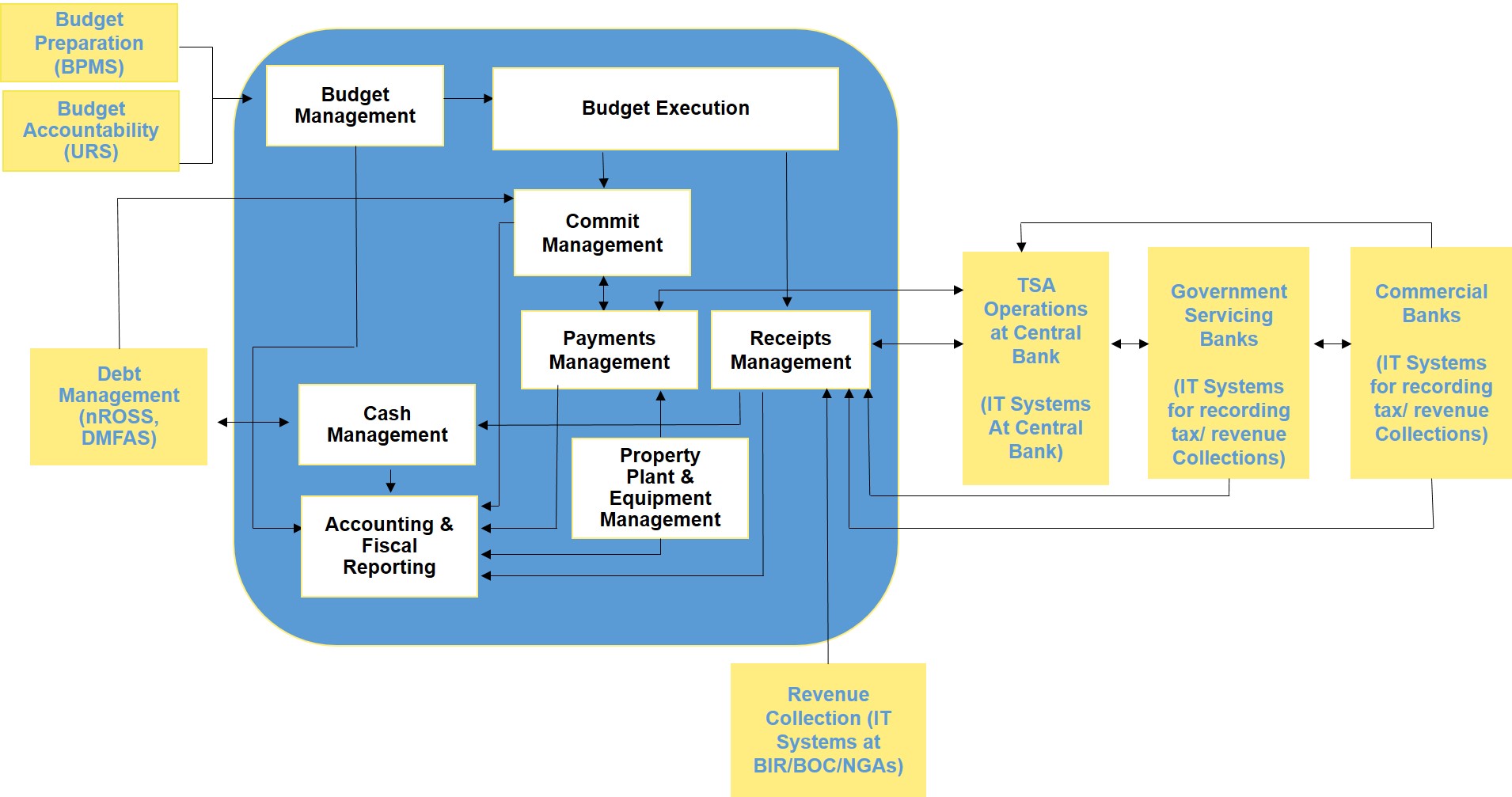

If the, instance, you deposit $five-hundred,000 toward a leading-produce checking account, the financial institution usually takes $3 hundred,000 of those loans to use once the an interest rate. To pay your, the bank pays 5% appeal towards membership a-year. So, because financial try getting 8% throughout the borrower, its giving 5% towards membership proprietor, netting they step three% inside notice. Ultimately, savers give the financial institution currency which, consequently, brings money so you can borrowers in return for desire.

If you’re interest levels represent attention income on the lender, it make up a cost away from personal debt to your borrowerpanies consider new cost of borrowing from the bank up against the cost of collateral, particularly dividend money, to decide and that way to obtain money could be the most affordable. Because most companies loans its funding from the possibly taking up debt and/or providing equity, the expense of the main city are examined to get to a finest financial support framework.

Apr against. APY

Interest levels to the consumer loans are generally quoted while the yearly fee price (APR). Here is the rates regarding get back one to lenders interest in brand new capability to use their cash. Particularly, the speed on the handmade cards is cited since the a keen ple more than, 4% is the Annual percentage rate to the home loan otherwise debtor. This new Annual percentage rate will not thought combined attention into year.

The newest yearly commission produce (APY) is the interest rate that is obtained in the a lender or borrowing partnership from a bank account otherwise Cd. This interest rate takes compounding into account.

Just how Is actually Rates of interest Calculated?

The speed billed by the banking institutions varies according to several away from circumstances, like the county of benefit. A country’s main financial (elizabeth.grams., the brand new Federal Set aside throughout the U.S.) establishes the interest rate, hence for every financial uses to determine the Annual percentage rate assortment they provide. In the event that main bank set rates of interest at a high rate, the cost of obligations rises. If the cost of personal debt are highest, it discourages individuals from borrowing from the bank and you will slows individual request. Interest rates will go up which have rising prices.